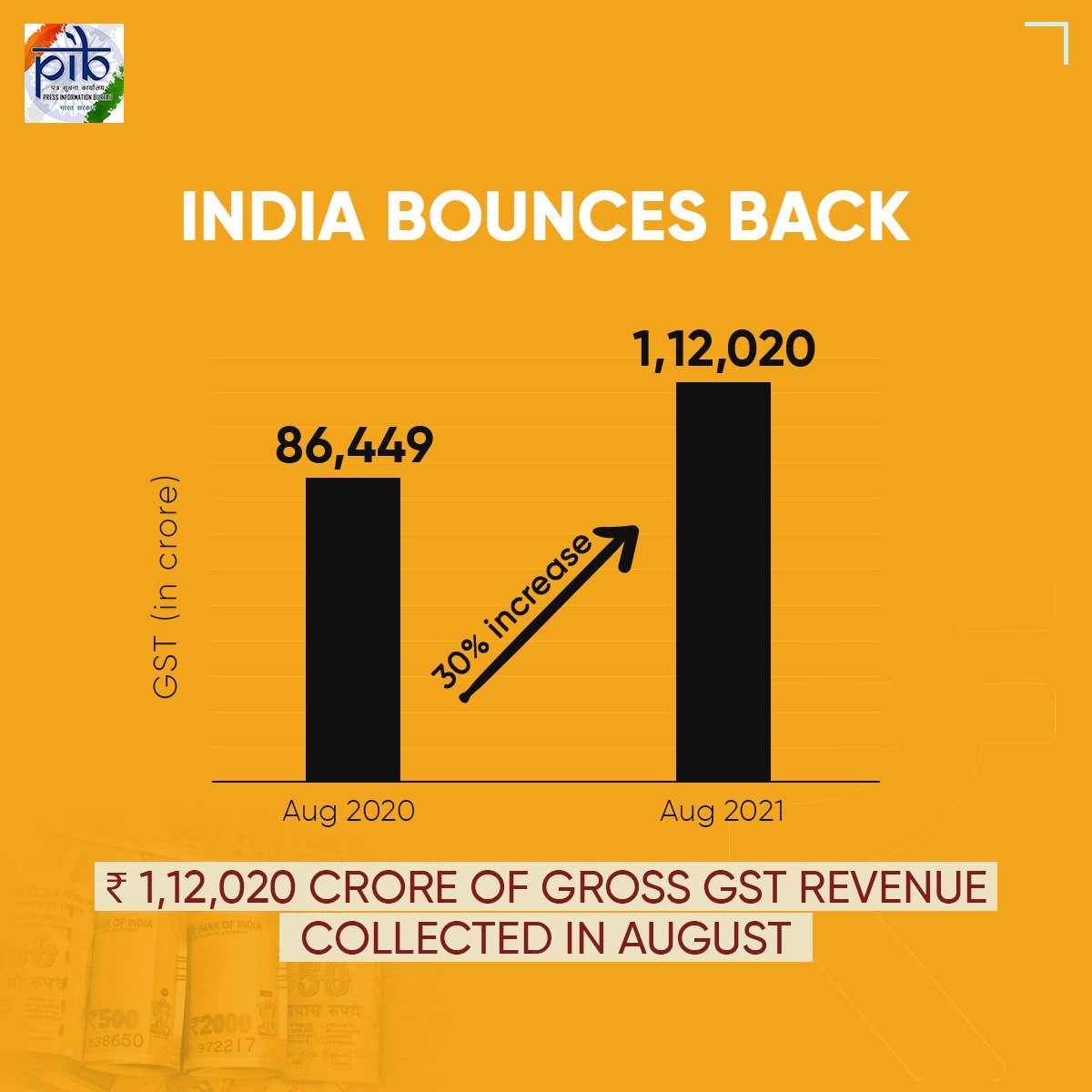

GST Revenue collection for August 2021

- ₹ 1,12,020 crore of gross GST revenue collected in August

The government has settled ₹ 23,043 crore to CGST and ₹ 19,139 crore to SGST from IGST as regular settlement. In addition, Centre has also settled ₹ 24,000 crore as IGST ad-hoc settlement in the ratio of 50:50 between Centre and States/UTs. The total revenue of Centre and the States after regular and ad-hoc settlements in the month of August’ 2021 is ₹ 55,565 crore for CGST and ₹ 57,744 crore for the SGST.

The revenues for the month of August 2021 are 30% higher than the GST revenues in the same month last year. During the month, the revenues from domestic transaction (including import of services) are 27% higher than the revenues from these sources during the same month last year. Even as compared to the August revenues in 2019-20 of ₹ 98,202 crore, this is a growth of 14%.

GST collection, after posting above Rs. 1 lakh crore mark for nine months in a row, dropped below Rs. 1 lakh crore in June 2021 due to the second wave of covid. With the easing out of COVID restrictions, GST collection for July and August 2021 have again crossed ₹1 lakh crore, which clearly indicates that the economy is recovering at a fast pace. Coupled with economic growth, anti-evasion activities, especially action against fake billers have also been contributing to the enhanced GST collections. The robust GST revenues are likely to continue in the coming months too.